Here is my monthly report of my personal net worth progress for March 2020.

I’m sharing this to show how important it is to track your net worth and seeing the progress. Tracking is what I also expect and advise my clients to do.

From tracking your personal net worth and see how much you are worth, you can learn what works and what you should change in your finances.

It’s the first step if you wish to go nomad or even to get to any goal in life.

If you’d also like to see how much you are worth the way I do, I created this tool, especially for my readers. You can get it here.

Also, if you’d like to read the previous report to get the flow of things, you can check it here – February 2020 personal net worth update. Here are all the previous reports.

If you don’t know what the net worth definition is, check it here.

Last thing, If you are looking to get your finances ready to go nomad, book a free financial fitness call with me. Just click the link and schedule a time on my calendar.

Let’s jump in!

Table of Contents

OVERVIEW

This month our net worth went down by 9.19%, and our savings rate was 44.25%.

Yep, as you see, the Sh%t hit the fan, and there is a significant drop in our net worth this month. It’s not pleasant seeing this. I updated last month that I bought more stocks as there was a drop. I had no idea how hard the coming fall is. Our net worth practically went back 16-17 months. I have a friend who went back three years in his net worth.

I might sound very pessimistic, which I’m not really. It’s all part of economic cycles, and as I’m in the game for the long run, I’m positive things will be ok.

A positive note is that our savings rate is back to a good number of 44.25%, which is excellent! I hope we can grow that number even more.

Kuetzal and Envestio lawsuits

I can’t update anything for now on this. But there is some progress.

Crowd Investing Alert

I started this page for following crowd-investing platforms projects. Now that there are only two platforms there, I’d like to add new ones. I’d like to hear your recommendations on it. Which other platforms would you like to see next in there? Please comment below.

So, if you are into crowd investing, give a ‘like’ to the page.

Crowdestor:

Crowdestor keeps publishing new projects and even started a project of investing in them. I didn’t get into this project, as I have no available cash in my account.

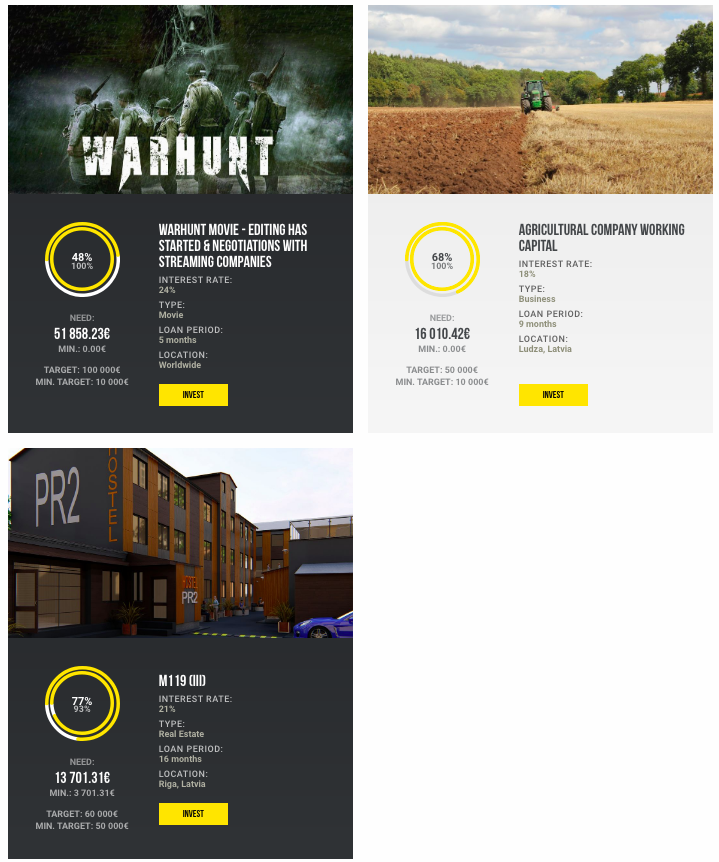

There are still other active projects running:

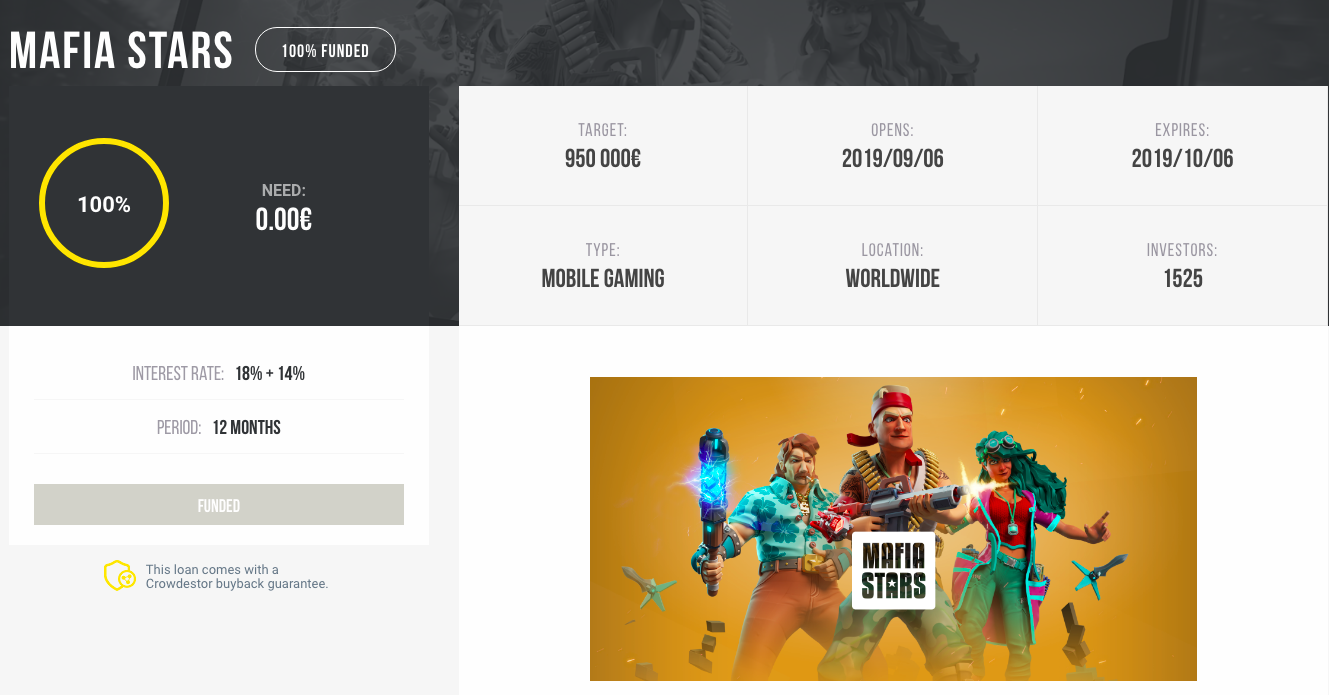

Warhunt movie project is running for a while now. I stopped counting how many times they added another funding project for this movie. I joined at the beginning when the returns were 18%, and you could get another 12% depends on the success of the film. They had the same model with a mobile game, and around half of my Crowdestor portfolio is in that game.

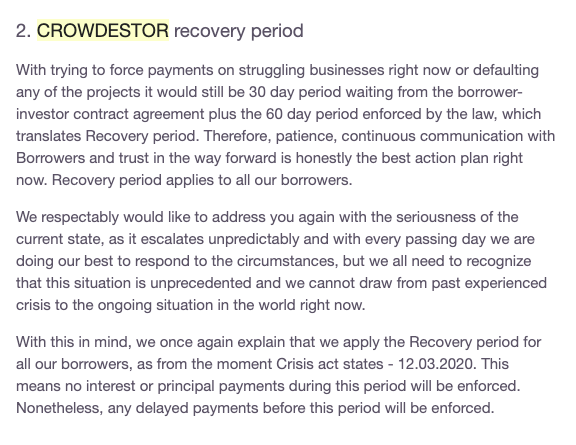

Because of the Corona Virus, Crowdestor issued this email to its investors, giving a grace period of 3 months to the borrowers. I understand the reason behind it, of course. Now it’s not standard times. And still, I was supposed to be paid nice sums this month, which are postponed now.

Here is the most important part of their email with the terms they presented:

Then a few days after that first message, a second one came, letting the investors choose the payment terms, resulting in the recovery period.

I wasn’t sure what to choose. The bottom line, I decided on option E trusting Crowdestore to represent my interest too in making decisions. After all, each project is different, and since I need to decide for all of them at the same time, that would not make sense.

I expect Crowdestor to review the projects, and in case they can pay on time, they should make them do that. IF that will cause them to collapse, I, of course, don’t want that, because I’ll lose my principle as well.

So, for the first time, I’m saying this: Not all Crowdestor projects were paid on time.

If you decide to join Crowdestor through my link, you’d like to get a 1% cashback for your next 90 days. I’ll get a bonus from Crowdestor of 1% of your investment about, at no cost to you. sign up through this link

Wisefund:

Wisefund still published project very slowly. A few days ago, they canceled a project I invested in. I got my money back, but without the interest since the investment date. They have another active project they promote.

Here are two projects:

Here is the current funding stat of Ravala Nordic Vermouth – Nordic by Nature project. I’m going to record this next month and see how far it was funded.

1-2 months ago, Wisefund presented a secondary market. It’s good for them to make instant cash (they take 1% from the investors for buying there). However, that hurts the funding of new projects. If I asses a project, with the same risk level but get higher returns on another one, I’d buy it in the secondary market.

I’m watching that market, and indeed there are great opportunities there.

Have a look at this list of loans (Their names don’t go on the same screen):

Look at the first row. If I can invest 2000 EUR (price column) and instead of getting a 20% return, I get a 74.65% return. I’d go with 74.65%. Of course, it’s assessing an old project vs. a new one, which isn’t simple.

The 74.65% doesn’t mean that the project is riskier, it means that somebody wanted to cashout from this project or from Wisefund platform totally at the price of losing more than 30% on their principle. In this case, you can buy a 3037 EUR loan for 2000 EUR.

For me, the amount is too large. But I’d go with the 400 EUR with 42.06% return (and I don’t mind paying 1% for Wisefund for this).

Anyway, my point is that there are interesting opportunities there.

Here is one important thing to remember. Wisefund is a new platform, and some investors in the crowd-investment community not sure if they will survive. Some even question if it’s legit. So, all this assessment comes at very high risk.

All Wisefund projects are paid on time, except, the one loan that was canceled.

If you do decide to join Wisefund through my link, I’ll get some bonus from them to invest more in my portfolio, and you’ll get an extra 0.5% cashback for the next 270 days after you invest.

LOANS & OTHER INVESTMENTS

UK property: This is a halt period, and there was no progress so far. I decided to expand my option and started researching on other real estate markets in other countries.

US property: Good news here. All three properties in Birmingham, Alabama, got sold. They will now pay-back to us, the investors, the rest of the money. There is still some amount that will not be distributed yet, to prepare reports of those investments for 2019 and 2020. Whatever is left after that will be distributed to the investors. This is a significant milestone. I’m in this investment since 2009!

Loans: No Updates here.

OUR PERSONAL NET WORTH ANALYSIS

US & Israeli Stock portfolio: Our portfolio was cut at about 14-15% from the previous month. Ouch!

Bitcoin: Bitcoin had a significant drop this month to around 3200 USD/BTC and then recovered to around 6500 USD/BTC. It’s still the lowest since about a year ago.

NOW OVER TO YOU

Does all this seem complicated to you? I don’t say it’s easy, but it’s not rocket science. You can do the exact same things as I do to reach your life goals.

So, what are you stuck with? What’s preventing you from doing the next step? Share in the comments or send me a message.