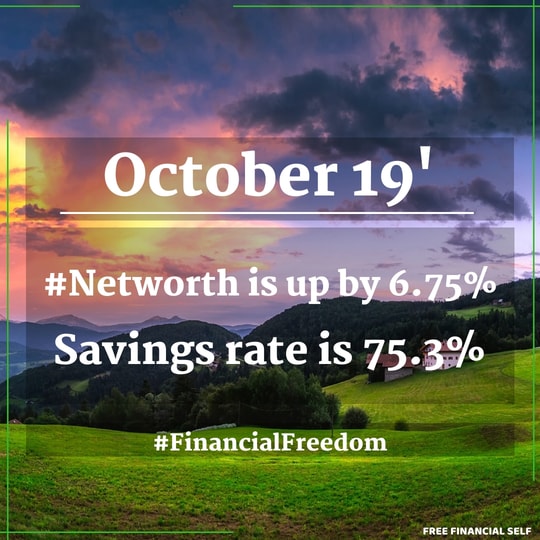

Here is my monthly report of our personal net worth progress for October 2019 and other financial and life updates.

I’m sharing this to show how important it is to track your net worth and seeing the progress. Tracking is what I also expect and advise my clients to do.

From tracking your personal net worth and see how much you are worth, you can learn what works and what you should change in your finances.

It’s the first step to eliminate money as a source of stress and gain confidence in your future finances.

If you’d also like to see how much you are worth the way I do, I created this tool, especially for my readers. You can get it here.

Also, if you’d like to read the previous report to get the flow of things, you can check it here – September 2019 personal net worth update. Here are all the previous reports.

If you don’t know what the net worth definition is, check it here.

I invite you for a free financial fitness call with me. Just click the link and book a time on my calendar.

Let’s jump in!

Table of Contents

OVERVIEW

This month our net worth went up by 6.75%, and our savings rate was 75.3%.

Our 2019 average savings rate is up to 44.52%

It’s the best month ever since I started tracking my personal net worth and finances. But, I’d be frank here. Because of technical reasons, my wife’s salary for next month came already at the end of October. So, that’s two salaries in one month (plus a bonus). So, let’s see the numbers next month. They suppose to be way lower.

Another thing that helped to push the personal net worth number up is that the ILS, which is my main currency got weaker against the USD and EUR.

On my travel plans, I’m already looking ahead at coming trips. So, if you are in New York City, London, Beijing, or Vienna, let me know. See a more detailed schedule on the travel section.

CROWD INVESTING

Crowd Investing Alert: I’ve been working on a secret project in the last month or so.

Here is the problem. When you are dealing with crowdinvesting platforms, it’s hard to keep up when they release new projects. Each platform has different standards of when to announce those projects. Some do it in advance, some only when the projects are live.

To solve that, I opened a Facebook page called Crowd Investing Alert (CIA for short), where I collect all future known projects and also announcing when they become live. Currently, I’m covering all four platforms I’m investing in, which you can see down below: Envestio, Crowdestor, Kuetzal, and Wisefund.

I also added a public calendar, where I put in all future projects coming live if there is info about those in advance. Using this you are able to see when new projects start in your schedule. A link to that open calendar is on the CIA Facebook page.

So, go to this page, give a like and show your love!

I’d love to get lots of feedback on this new project and improve it. So, don’t be shy.

I want to mention another exciting initiative by a fellow blogger called TORCH by Ido Shkedi. This project aims to analyze the transparency of different p2p and crowd-investing platforms to show how safe they are (or not). So, if there are things that look fishy, let the platforms know what they need to change and raise the standards in the industry. Check out the link and support I do and his project.

Envestio: On Envestio, not a lot to add. For most of the month, I had a cash drag, and then they started releasing projects at a good pace. There are currently three projects running live with yearly returns of 17.5%-19% yearly returns.

If you do decide to join Envestio through my link, I’ll get some bonus from them to invest more in my portfolio, and you’ll get an extra 5 € bonus + 0.5% cashback for the next 270 days after you invest.

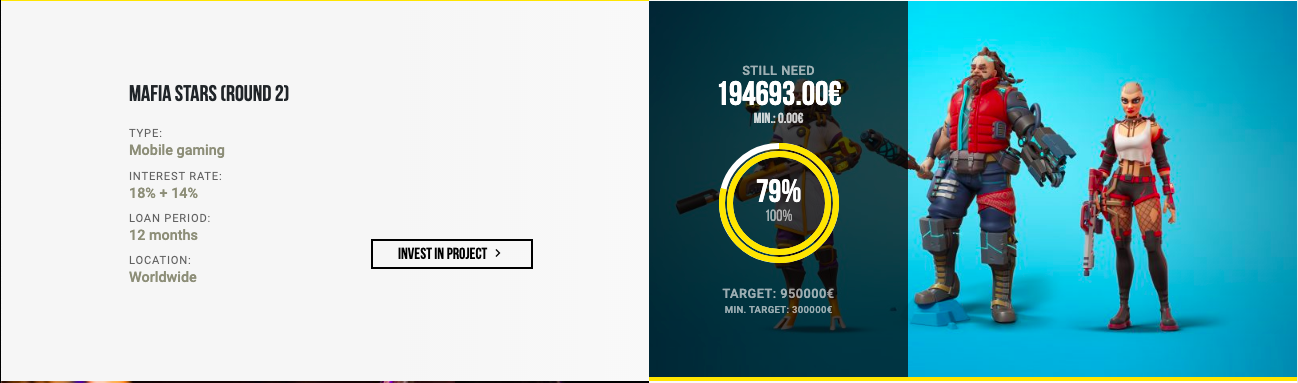

Crowdestor: Crowdestor, On the other hand, is releasing projects like crazy. At the time of writing these lines, there are four live projects and 3 coming up projects for investments. No less!

Crowdestor is also unique by offering extra returns in addition to the interest returns of the loans, which are performance-based. Currently the game Mafia Stars with 18% (loan returns) + 14% (performance returns) is open.

An additional project like this is a movie called Warhunt (Currently with 18% (loan returns) + 12% (performance returns) is open.

If you decide to join Crowdestor through my link you’d like to get 1% cashback for your next 90 days. I’ll get a bonus from Crowdestor of 1% of your investment about, with no cost to you. sign up through this link

Kuetzal: Kuetzal is slower in releasing projects. It’s the 3rd newest, and I assume it will take a bit more time to get more projects fast enough. Also, I don’t like the fact that the minimum investment is 100 EUR on their platform. So, it can take longer until you can reinvest your money.

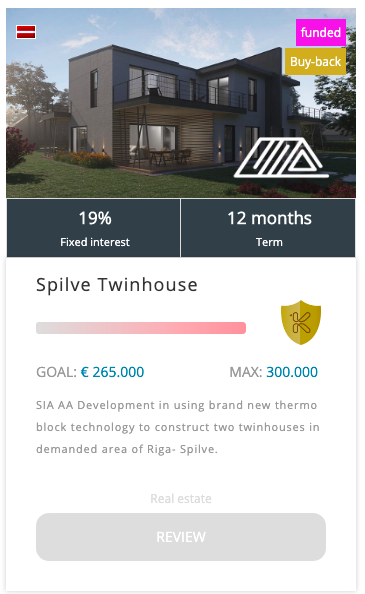

Here is the last project I invested with them. It’s a real estate project and gives a return of 19% yearly.

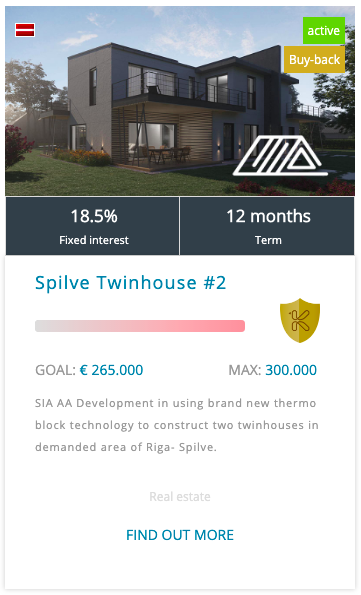

They have another tier of this project still open for 18.5% return a year.

21.1.20 Update: I no longer recommend Kuetzal. I invested through them. However, large parts of that business were a scam and under investigation. I’m not sure I’ll see my money back in this case.

If you do decide to join Keutzal through my link, I’ll get some bonus from them to invest more in my portfolio, and you’ll get an extra 0.5% cashback for the next 180 days after you invest

Also, use the coupon code FREEFINANCIALSELF when you join. You’ll get 15 EUR bonus instantly into your account that you can invest right away.

Wisefund: Wisefund is the newest platform of all the ones I’m in. I added more funds this month to their platform as I have significantly less money there than on the other platforms. I also hope that they will release projects faster, as I have funds there now ready and would like to diversify into more projects.

Currently, there are 3 projects that are live with returns of 14-18.5 %. What I like about Wisefund is the fact they have projects in more regions than the other platforms, allowing for more diversification.

If you do decide to join Wisefund through my link, I’ll get some bonus from them to invest more in my portfolio, and you’ll get an extra 0.5% cashback for the next 270 days after you invest.

LOANS & OTHER INVESTMENTS

UK property: I met my contact person helping me with the scouting for deals yesterday. No news for now, but the reason for the meeting is my upcoming trip to the UK. I hope to go and see some properties there.

US property: After a long time, more news on these investments. Since the last update I got, 3 out of the six houses on the portfolio were sold. The other 3 suppose to be sold by the end of 2019. I don’t hold all these properties by myself but with other investors.

I’m looking forward to releasing that money and invest it somewhere else.

Loans: So, I told you that we got excellent loan terms about two months ago. This month I tried to get more credit from the credit card company, but they refused. I’ll keep working on this. From our mastermind join learning (see below), I learned that the sequence of return is the real enemy of keeping your money’s value when you retire. The best way to cope with this is borrowing when you are on the accumulation stage and invest the money. This method enable you to average your returns over bad times coming while you are in the retirement stage.

Nexo: Since I’m waiting for a long time now to invest is that UK property, I have some of the money sitting at the back. That’s not a good strategy since you lose its value because of inflation. I started looking at a few solutions out there, which will be better than leaving it in the bank and get the almost zero returns they offer now.

Nexo is something I came across, along with other platforms like Bondora Go&Grow and Iban Wallet. All three platforms have a non-commitment option and a daily interest payment for your funds parked there.

Here are the yearly returns offered by each:

- Iban Wallet – 2.5%/Year

- Bondora Go&Grow – up to 6.75%/Year

- Nexo – 8%

Of course, because of the returns, Nexo is the most interesting, but Bondora is also a good candidate.

I still want to have a deeper look on those. Are you interested to see an analysis and review of my findings of these platforms? Please leave a comment below then. If there is a demand, I’m glad to write about it.

By the way, Nexo is so much more than just a lender, as I can see. You can park your cryptocurrency there too and get money back as a loan. I Haven’t finished my research yet, but it does look interesting.

OUR PERSONAL NET WORTH ANALYSIS

US & Israeli Stock portfolio: Overall, the portfolio when up nicely this month, a total of 1.9%.

US Real estate investment: As I mentioned above, I hope that by January, this investment will be sold. For now, it went up a bit, thanks to the ILS/USD rate.

Bitcoin: BTC had a drop this month, so we decided to invest in it a bit more. Overall, it’s back up so, we made some profit there (So far).

PERSONAL LIFESTYLE & PROFESSIONAL LIFE UPDATE

INTERVIEWS

Jim Beach from School For Startups interviewed me. I share a lot about my China story and of course, about Free Financial Self. Unfortunately, I can’t embed their player, so if you’d like to listen, go this page

Anyway, here is the video addition.

Another interview I had (in text, this time) was for Hero Story by David T. Domzalski. I think the most interesting question is about the two moments that shaped who I am today. Have a look here

TRAVEL

As I mentioned above, I have a few trips planned for the next 4-5 months.

- Beijing- (Moved to) December

- London – Mid-December

- New York – 12th – 19th of February

Planned but no date set:

- Ski trip with my daughter. I want to take her to a ski school in Europe. Probably in the Czech Republic.

- Family trip to Europe

If you are around, get in touch and let me know. I always like to meet my readers.

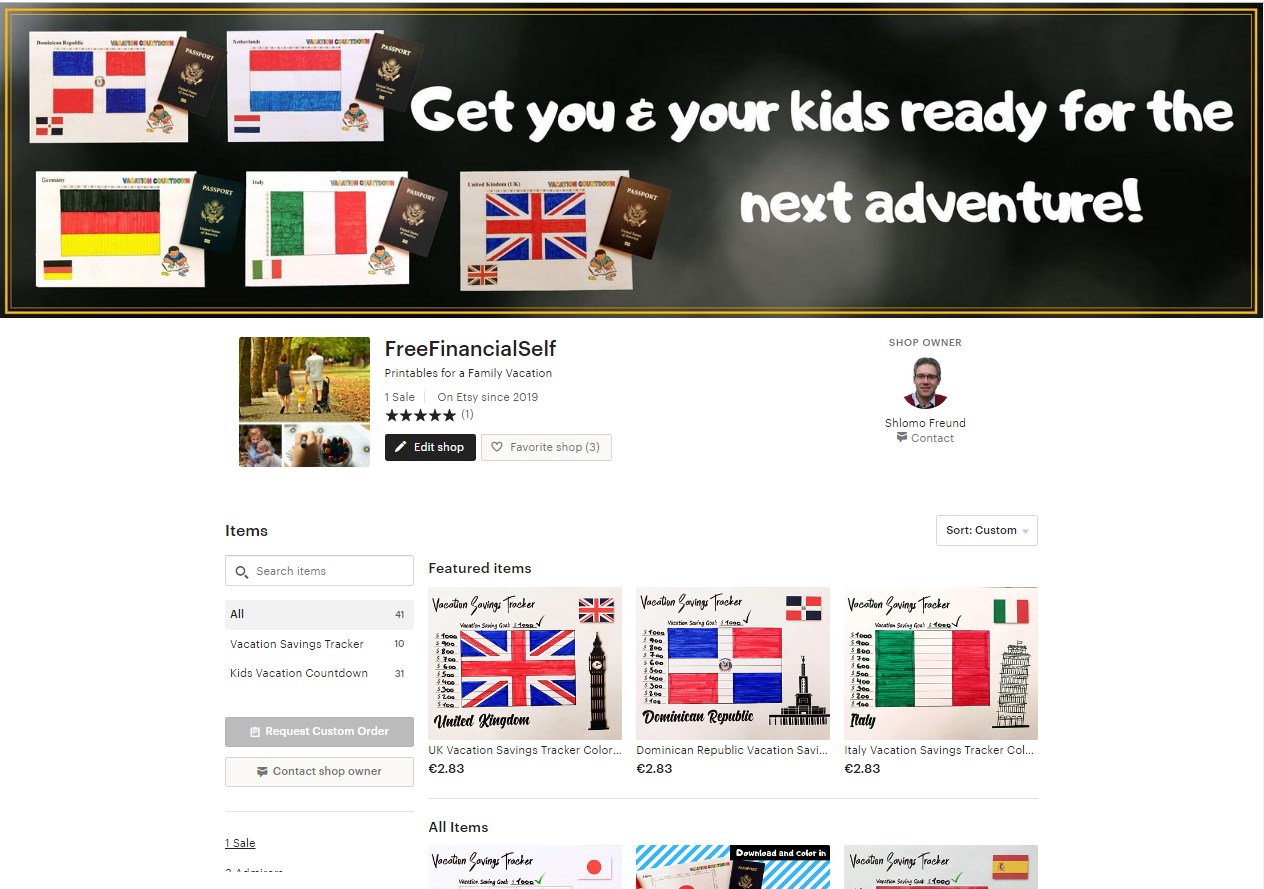

ETSY STORE

No changes in my store this month. I now have products for adults and not only for kids.

In a nutshell, let’s say you’d like to save for a vacation somewhere. I created a vacation savings tracker for people to visually see how much they saved for that vacation and keep them motivated towards that goal of making it happen.

I have this product for ten countries so far (Italy, France, The Bahamas, Spain, Germany, Japan, Jamaica, The Dominican Republic, the United Kingdom, and India).

For kids, I created countdown activity for the family vacation (31 countries so far). The kids can color the flag of that target country counting down the days before the trip.

Here are two examples:

READING UPDATE AND READING CHALLENGE

I finished a book called Inside the Third Reich by Albert Speer. I highly recommend this book. This is my review on it on Goodreads:

If I could, I’d given this book 7 stars.

Why?

It’s a first-hand testimony of what was going on in the ’30-’40s in the Nazi government. The most fascinating part is a deep understanding of who Hitler was, how did he make decisions and how such a disastrous dark time on human history actually happen.

Not only, this amazing testimony understanding history, but it’s also an amazing thriller book, but one that really happened.

a MUST!

I’m currently also reading the book Man’s Search for Meaning by Viktor E. Frankl. The first part is about his experiences as a prisoner in the Nazi death camps, which was very interesting. The 2nd part is about his treatment method called Logotherapy. It’s much harder to read. So, I’m reading it slowly.

I’m also reading a book called The Opposite of Spoiled: Raising Kids Who Are Grounded, Generous, and Smart About Money by Ron Lieber. It’s also an interesting read. It tries to answer questions kids have about money and how to cope with them. He suggests a method for giving allowance to your kids. It’s called: Spend, Save, Give.

We decided to give try it, and till now, it works great. We give our daughter four coins, where she put two of them in the Give jar and then a single coin in each of the other two jars; Spend and Save. It helps with arguments on buying different things, telling her that she can buy it with her allowance, once she has enough money.

I’ll write a more detailed post when this experiment is more mature.

The last book I’m reading is the Hebrew version of Putin’s Oil: The Yukos Affair and the Struggle for Russia by Martin Sixsmith (3-4 at a time, that’s a lot for me!)

I learn about the relationships and different powers in the Kremlin; I had no idea about.

EXERCISE

A bit better on this front. Not yet consistent. But I decided that my goal is to be able to be flexible enough to touch my toes without bending my knees. So, I have a set of 4 exercises I need to do several times a day. For now, I do it just 1-2 times. I also go to a Yoga class once a week, so this helps too.

MASTERMING JOINT LEARNING

So, we did our last discussion of parts 16-31 of The Ultimate Guide to Safe Withdrawal Rates from Early Retirement Now blog. I slacked and still need to finish reading the last three posts of it.

Then each of the members shared how this learning helped him with his investment decisions towards financial freedom.

I shared that I’ll keep going with my strategy of borrowing now to cope with a sequence of return risk.

Also, I’m happy sticking with cashflow FI (have an ongoing passive income that is larger than your expenses). This is why I’m still looking to go into more real estate investments. Crowdinvesting also helps, but it’s a higher risk.

FINANCIAL INDEPENDENCE EUROPE GROUP

In August, I joined as an official moderator of the Financial Independence Europe Podcast Facebook group. I invite you to participate as my readers to the group and have fruitful discussions.

NOW OVER TO YOU

So, how is this update helping you?

Did you discover anything new?

Are you tracking your finances and see the progress?

Is this update too long? Boring?

Feel free to add a comment, I read them all and promise to reply.

Comments

Hi Shlomo!

I liked your book list and books reviews section. Now I’m thinking about adding one to my blog:) I will definitely read “Inside the Third Reich” after I finish reading Yuval Noah Harari books. Have you read them?

I will definitely check CIA TORCH projects. Regarding your portfolio. If I understand correctly you don’t want to disclose your numbers, but can you at least share what stocks you have in your portfolio and a bit more information on those US properties and their return?

Btw, why you are not investing in real estate in Israel? I heard that rent/price ratios are not very interesting there. Is it true?

Thanks and best wishes!

Hey,

Thank you for your comment. No, I haven’t read Noah Harari’s books yet. They are on my list, but really there is so much I want to read as you see on my good reads profile.

As for sharing the actual stocks, I can’t do it as I’m following the recommendations of a value investor and I pay a subscription for this. So, it’s unethical doing so. Would sharing the industries types is interesting for you?

The US properties investment is since 2009 and been doing an average of 4%/year returns. Not great. I invested with a group of people. So far these group real estate investments I was in (There were 2 of those) weren’t as lucrative as I thought. This is why as you see, I’m going into finding my own properties right now. This, of course, takes longer to achieve.

Real estate investment returns in Israel are relatively low, also the property prices are very high.

So, it’s a large barrier of entry, with bad returns. Not my cup of tea 🙂

You mention on your blog that you are not a native English speaker. May I ask, where are you from?

“Would sharing the industries types is interesting for you?”

Industries/countries would be better than nothing 🙂

I’m from Estonia.

Btw, how can I subscribe to your blog? 🙂

“Industries/countries would be better than nothing 🙂” – Sure, I’ll share more about in the next post

I just found out that the registration bar is gone. I will fix it.

Investforfinancialfreedom, To your request. Investments industries and breakdown added. Please check the new monthly post.: https://freefinancialself.com/2019/12/08/november-19-net-worth-report-and-more/