What’s going to happen if my startup fails? How can I feel more stable with unstable income?

Let’s be honest about this. It’s terrifying when your future is not determined, and you are yet to succeed with your startup. Most startups fail, and it’s a financial risk compared to collect the pay-check once a month.

Here is a principle that can ease it on you in the long run.

Personal finance 101 for entrepreneurs to the rescue! Read on!

I think that I read “Rich Dad Poor Dad” by Robert Kiyosaki about 15 years ago. I enjoyed reading it since it was a great eye-opener.

If you were living on another planet since then, “Rich Dad Poor Dad” is a series of books basically all saying that you need to build assets in your life to generate more income for yourself in the future. Building assets is a way to grow your capital instead of just changing your time for money either with a job or with doing consulting work.

Having a regular job has two problems:

1. If you stop working, you will stop having an income.

2. It has a limit. As you change your time with money and since time is limited, the potential of your earning is limited as well, there are only 24 hours a day.

It’s been long since I had a day job, and I prefer being an entrepreneur, have the flexibility I like, and the lifestyle I desire. I’ve learned a lot about personal finance and how to handle my income much better over the years.

Before reading the book, I just thought that every couple of months after saving X amount of money, I’d spend it all on my next trip. This is how I wanted to live my life.

Afterward and even more today, I know it’s a mistake. I learned that if you invest your income (even the tiniest), it would worth much more in the future and would enable you to do much more with it. You create assets!

Why is Personal finance so vital for us as entrepreneurs?

Here is why:

We are ambitious; we raise money (sometimes), create products and services. So, we do all those things that create value for others.

But at the end of the day, what do we do with the money we earned? Handling that money wisely can be your “insurance” that if your startup fails, you are still left with some assets and even much more. It creates stability.

Table of Contents

So, what is this asset you are talking about, Shlomo?

An asset is something that makes money even when you are not directly working on it. It has a very sexy word these days: passive income.

For example, If you buy a house and you rent it out, you get a passive income. It’s not related directly to your job, and even if you stopped working, the income from renting out your house would keep flowing into your bank account (assuming the tenants are paying)

Another type of asset is stocks and there are many types of them. Yes, they fluctuate but some of them pay dividends every certain amount of time which is paid back to your account. These dividends are paid to you just because you held the stocks at the right time when the company paid dividends to its shareholders.

Are you kidding me?! I’m an entrepreneur; I don’t have money to make money-making investments.

Well, I can’t argue with that. Entrepreneurs are fighters! We usually don’t have extra money for investments, but even if you put aside a small amount early on, it’s so much worth it for the rest of your life.

Let’s say you have $1 to invest. Only $1!

What happens if you invest it and get 10% interest for it over a year?

At the end of the year, you will have: $1.1

Invest that $1.1 again for a year at a 10% interest, and at the end of the 2nd year it’s worth: $1.21

Did you see what just happened? The revenue of the 1st year was $0.1, but in the 2nd year it was $0.11

So, your money grew at a more substantial sum just because you left the original amount + the first-year interest for another year of investment.

Let’s do the same thing for the 3rd year.

Take our $1.21 and invest that in a 10% interest rate for a year. At the end of the year we will have: $1.21 + 0.121 = $1.331

By how much our money grew each year?

1st year: $0.1

2nd year: $0.11

3rd year: $0.121

We can keep going on and on with the example. The point is that every year we earn more than in the previous year. Our money grows exponentially because of an effect that is called Compound interest.

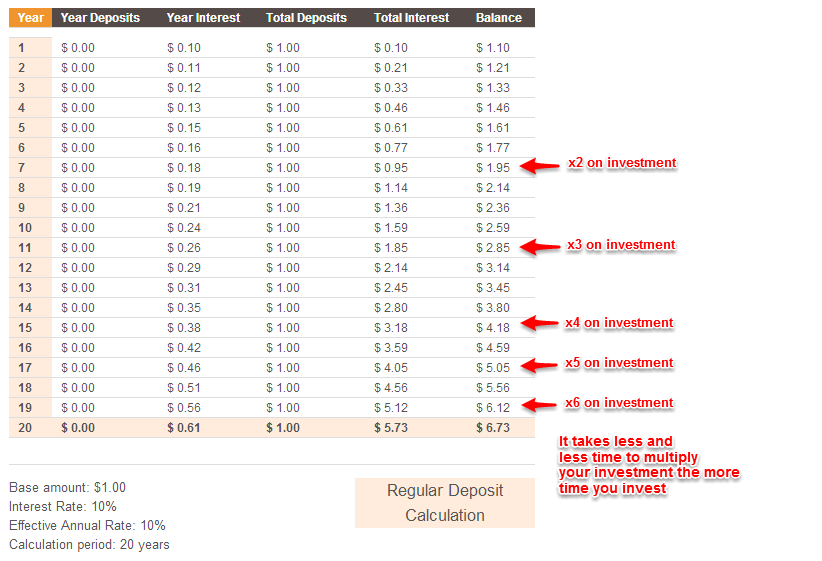

Here is what’s going to happen after 20 years:

After 20 years, you will have $6.73! It’s 673% more than your original investment!

Here is how I made these calculations (we won’t get into formulas here). I invite you to do the calculations and see for yourself. Change the numbers and plan your future.

What’s the conclusion then?

Very simple! Start early! Start saving that $1 early in your life because the more time the compound interest is working for you, the easier it gets, and the more money you make passively!

Now imagine this $1 is actually $10, $100, $1000 or even $10000. Multiply each by 6.73…Not bad, huh?

Why am I telling you all this?

Personal finance is an extremely powerful thing to master. Even if you don’t consider yourself an investor, in the long run, it can be the difference between you struggling your whole life or living well. So even if you are poor in your early life, it’s essential to put aside $1, just $1!

Here is a video I created that explains it all:

Not sure where to start?

How to create a system to make it work so you can keep working on your business or become a nomad or both?

Not sure how to compound your money to have a more stable life? reach your life goals?

Get in touch here and let’s talk.

Photo credit by Alexandre Normand