This is my monthly report of our personal net worth progress for July 2019.

I’m sharing this to show how important it is to track your net worth and seeing the progress. This is what I also expect and advise my clients.

From tracking your personal net worth and see how much you are worth, you can learn what works and what you should change in your finances.

It’s the first step to eliminate money as a source of stress and gain confidence in your future finances.

If you’d like to also see how much you are worth the way I do, I created this tool, especially for my readers. You can get it here.

Also, if you’d like to read the previous report to get the flow of things you can check it here – June 2019 personal net worth report. This is the page with all previous reports is here.

If you don’t know what the net worth definition is, check it here.

I invite you for a free financial fitness call with me. Just click the link and book a time on my calendar

let’s jump in!

Table of Contents

OVERVIEW

Well…before I’ll actually jump in. Here is something I’d like to share. I’m been publishing this report (Which by time became a whole update…) since November 2017, that’s 20 months in a row!

The reason I started it, was because I wanted to inspire others of how they can combine their desired lifestyle and finances. Which is exactly what I do for myself. I enjoy preparing this report, as it also helps me to keep track of my finances and has a monthly recap of what’s going on in my life.

As I keep changing and improving the format, I’m really interested to know how this update can help you better? What would you like me to change? Would you like me to talk more about other topics? Is it too long, and you’d like me to remove content (don’t be shy saying this…), it did become pretty long.

Also, is this kind of monthly update helping you in any way? Does it inspire you with new ideas? Does it keep you motivated? I’d love to hear such stories also.

This month I’m adding a table of content to the update, so you can just jump to the part that you like most.

But, please send me back a message or leave a comment. Of what else you’d like to see or be removed?

Now, on with the show!

—–

This month our personal net worth was up by 1.49% and our savings rate was 68.29%. This has been another good month. The savings rate is very good. The 2019 yearly average so far is a bit low in reference to what I’d like to achieve. It’s now 40.36 %, but I’m expecting a few strong months coming up, so I anticipate the average savings rate to become better.

A special remark about currency exchange rates here. Our portfolio could have done a lot better, but the exchange rate for USD, EUR and GBP dropped significantly in exchange with Israeli Shekel (ILS).

So, as an example. We are making a consistent and growing income from crowd investing (See below), in Envestio, Crowdestor and Kuetzal. But ,it’s growing only if you use EUR. As on my calculations, I convert it to ILS, the worth of these investments actually went down.

On the other hand, the fluctuating currency exchange can bring good opportunities. As we are about to buy a UK property (See below), the cost of that property it dropping now, because British pound is now significantly lower rate than it used to be against USD, EUR or ILS.

Crowd Investing

Envestio: Envestio managed to be great and disappointing at the same time this month. On the disappointing side, they introduced only a single project this month. I didn’t want to put all my cash in a single project there, so I put about half of it. So, I’m still suffering from cash drag.

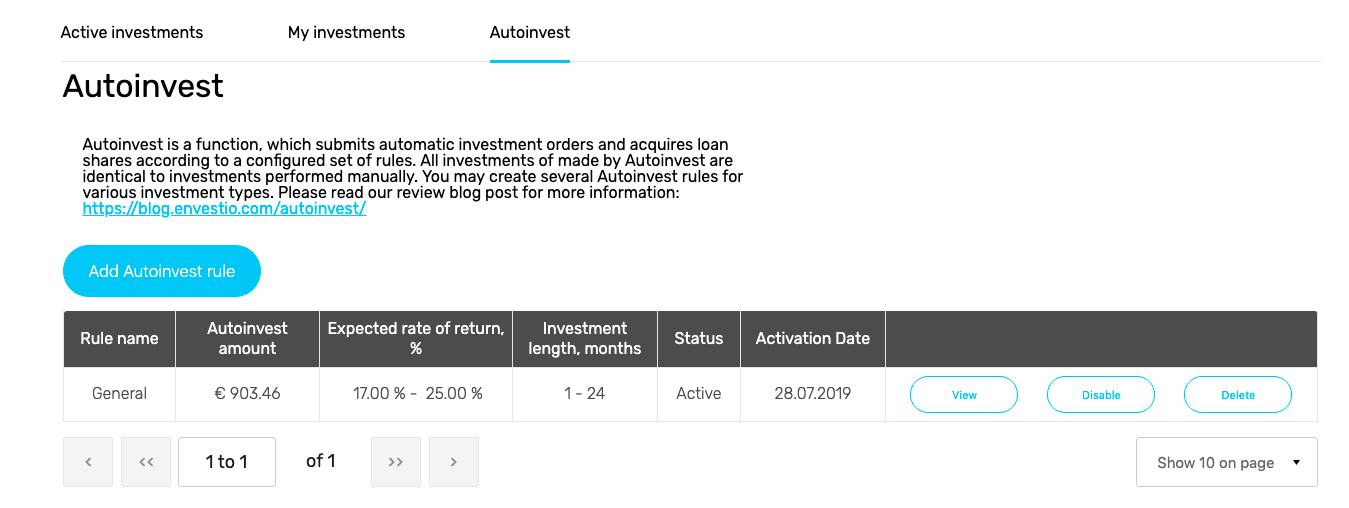

On the positive side, they finally introduced the auto-invest system they have been talking about for so long, which is awesome. I immediately put in a rule to the auto-invest system.

It already happened a few times that their projects were funded in a matter of minutes, as I reported here previously. So, with auto-invest, it increases the chances of succeeding to invest in a project.

Here is how the auto-invest rule I used looks like:

If you do decide to join Envestio through my link, I’ll get some bonus from them to invest more in my portfolio and you’ll get an extra 5 € bonus + 0.5% cashback for the next 270 days after you invest

Crowdestor: Crowdestor, are doing much better in introducing new projects than Envestio. They keep releasing them at a steady pace which is nice. The minimum investment per project is 50 EUR. So, whenever I have that amount accumulated in my account from the interest of other projects I re-invest it.

However, Crowdestor has a few projects where the interest is only paid after 6 months and only then monthly. So, getting your returns and re-investing them can take longer with them.

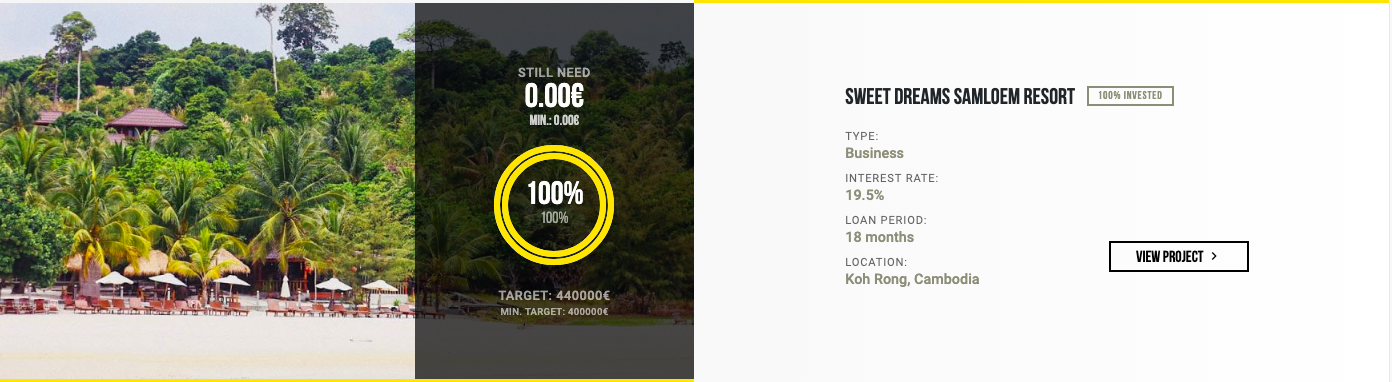

This month they introduced a project that runs in Cambodia. I was happy to invest in that one and diversify from the Latvia centered projects. It also gives a nice return of 19.5% a year.

You can check more of Crowdestor’s projects on their website.

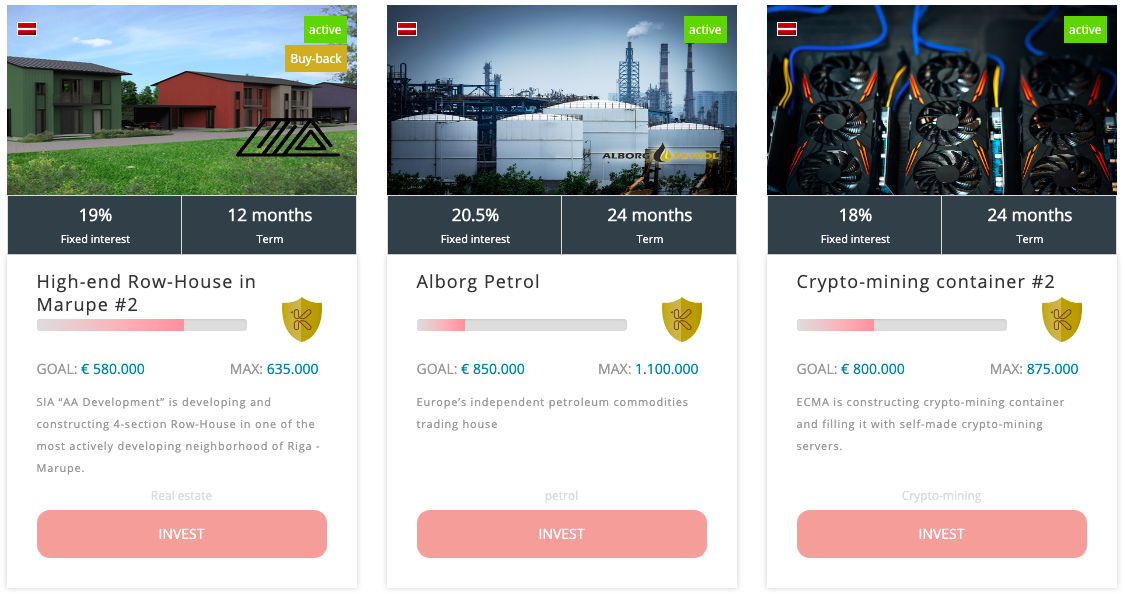

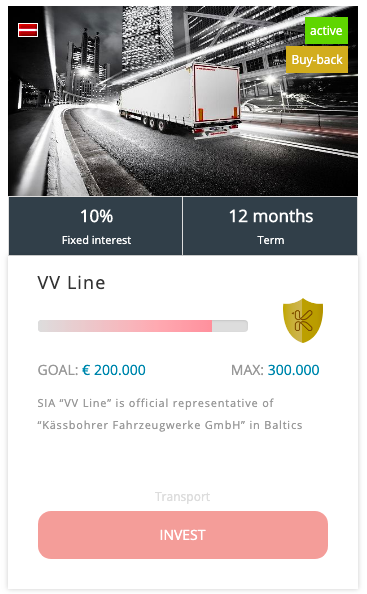

Kuetzal: Kuetzal is the newest crowd investing platform among the 3 I’m using. They give good returns. However, Kuetzal projects hold for a very long time on their platform. Sometimes it feels like it’s too long.

This is why they have the following promotion until the end of the month.

They give you at least 1% cashback on investments larger than 1000 EUR in a single project. Now pay attention here, because I made a mistake and lost money. You need to have a single deposit in a single project and not have any 1000+ EUR split between a few projects. I didn’t get that and therefore for some of the projects I didn’t get my cashback bonus. It’s annoying, but Kuetzal was kind enough and added 10 EUR to my account as a compensation.

Here is the table of the cashback. You get instant 1-3% return on the investment right away into your account and of course, can invest it again if you’d like or withdrew as a profit.

As I’m writing this post, they have 4 projects looking for funding from 10% yearly returns to 20.5% yearly returns. All of those in Latvia.

21.1.20 Update: I no longer recommend Kuetzal. I invested through them. However, large parts of that business were a scam and under investigation. I’m not sure I’ll see my money back in this case.

If you do decide to join Keutzal through my link, I’ll get some bonus from them to invest more in my portfolio and you’ll get an extra 0.5% cashback for the next 180 days after you invest

Other investments

UK property: My last update was that we moved to the additional property and now looking to purchase a student apartment building in the UK. We will not buy it by ourselves, but with other partners, which will keep the purchase price around our means. We are still negotiating, so nothing new to say here yet.

Let’s dive into the details of our personal net worth.

OUR PERSONAL NET WORTH ANALYSIS

Loans: I’m in the process of re-financing all our loans, thanks to a member-only credit card we managed to get. They give loans for 1.25% a year which we are hoping to get. We are now at the documents stage, going back and forth and I hope to have good news on my next update here.

US & Israeli Stock portfolio: Our portfolios dropped a bit this month. Nothing too terrible.

US Real estate investment: No news here, I hope to have some news within the next 2 months on this.

Bitcoin: Bitcoin is fluctuating but still around the same price of 10000 USD per bitcoin. Not a huge change for us.

PERSONAL LIFESTYLE AND PROFESSIONAL LIFE UPDATE

Birthday

This month I celebrated my 40th birthday. Many mention the 40’s crisis which I don’t have (or so I think). I’m happy with where I am and who I am in my 40th year. I like what I do, and glad I have the family that I have. I am also very happy with the flexible lifestyle we built for us. I thank on all those things many times in the last few weeks especially.

I celebrated a few evenings with different people of different circles which was great (I haven’t gone into a Kareoke bar for more than 15 years!).

We went out with my best friend and his wife to a whiskey bar, had a special bicycle trip with my wife and daughter around Jerusalem and my last celebration was with my close family in our yurt where we invited them all for dinner.

Travel

We are still planning our trip to Europe, but due to family reasons, we are not yet sure, when and if we will actually do it. Things should clear up in the next 2 weeks. Let’s see.

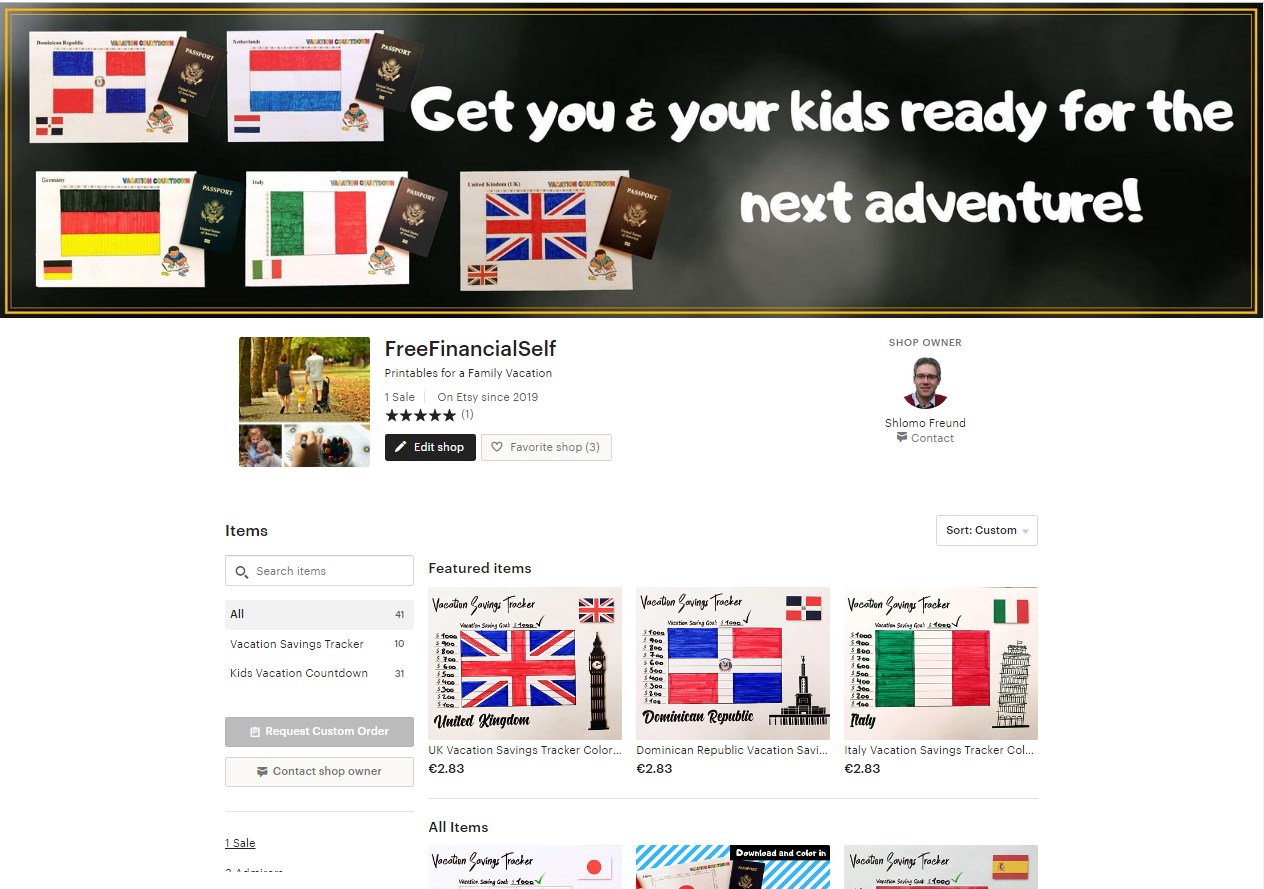

Etsy Store

I have new products in my store now. I now also have products for adults and not only for kids.

In a nutshell, let’s say you’d like to save for a vacation somewhere. I created a vacation savings tracker for people to visually see how much they saved to that vacation and keep them motivated towards that goal.

I have this product for 10 countries so far (Italy, France, The Bahamas, Spain, Germany, Japan, Jamaica, The Dominican Republic, United Kingdom, and India).

If you plan to go there and need a push to stay motivated towards your next vacation, check out my store.

Travel and social impact

This one is super important. I built a campaign to get a heart surgery for the former kindergarten teacher in Sri Lanka of my daughter. She got a heart attack and didn’t have the funds to have it.

So, although I didn’t manage to raise all the amount needed, I raised a significant part of it. I got a message earlier today that she just had the surgery and her life was saved!

It’s all thanks to all the wonderful people who read this blog, China Business Cast community, friends, Europe FIRE community and influencers (Talking to you, Mr. Mikkel Thorup from Expat Money Show) that helped to push this campaign. I can’t mention everyone, but I really thank each and every one of you for making this happen.

You saved her life and gave hope to those children in that kindergarten! Thank you!

Reading update and reading challenge

So, reading pace has slowed down and I’m afraid I’ll hit my reading goal, but frankly, I hoped to pass it.

I finished reading Expat Secrets: How To Make Giant Piles of Money, Live Overseas, & Pay Zero Taxes by Mikkel Thorup. Mikkel has a unique approach to protect you financially from any catastrophe you can think of by basically diversifying your life. I got a few ideas from this book. Implementation is hard though.

I also finished reading a book called Good to Great: Why Some Companies Make the Leap… and Others Don’t by James C. Collins . What I liked in this book, is that through research that was done. They were able to really distill principles that have a strong basis.

I’m currently reading The Growth Hacking Book: Most Guarded Growth Marketing Secrets The Silicon Valley Giants Don’t Want You To Know by Parul Agrawal . Nothing to say on it yet, as I haven’t finished. a remark on the structure. The book is consisted of separate articles, giving you the different aspects of growth hacking, so each one of these is a stand-alone and not a continuation of the previous article/chapter.

I invite you to follow my Goodreads profile and read along with me. I’d love to share ideas.

2019 Reading Challenge

Learning Italian

I started learning Italian! Why? This is because we are planning a trip to Sicily mid-September and I’d thought it’s a good motivator to be able and speak there. I know some Spanish already so I thought learning another roman language shouldn’t be that hard. Read some more of why I started here.

I took another idea from Olly Richards who was a guest at the expat money show and started using italki.com to find community teachers and just speak with them.

Exercise

As for my exercise, I actually broke my habit for something like 10 days and now started to get it rolling again. It’s not easy, but easier than starting from scratch as I already have the system in my mind which I keep tweaking. My last tweak was just too much of a change, so it killed my routine. So, I’m going back to my basics exercises and will improve from there.

Mastermind Joint Learning

On my weekly mastermind, we started out an interesting project, which is joint learning. We decided that we all want to learn something together and then have everyone asking questions and help each other understand deeper the learned topic. So, this is our first try doing this. We chose to learn together the first 15 (out of 31) parts of The Ultimate Guide to Safe Withdrawal Rates from Early Retirement Extreme blog. It’s very interesting and I encourage you to read it too. If you know of the whole discussion of the 4% rule in the FIRE community, that this analysis, will open your eyes with some new data.

https://www.instagram.com/p/B0OvUO1oP2G/?utm_source=ig_web_copy_link

https://www.instagram.com/p/B0dDk0shj03/?utm_source=ig_web_copy_link

NOW OVER TO YOU

So, as I mentioned, how is this update helping you?

Did you discover anything new?

Are you tracking your finances and see the progress?

Is this update too long? Boring?

Feel free to add a comment, I read them all and promise to reply.

Comments

Close to 70% of a savings rate is really impressive! We are on the opposite side this year. After several years of boosting income and savings, we’re on a spending year as our youngest goes off to college (very expensive in the US) and we take some time to do more travel now that we’re not tethered to any one location. Being a natural saver, taking the year off is something I really had to work towards, and I’m still struggling with the mindset shift.

Like that you’re reviewing safe withdrawal rates. I think the 4% rule has come under question for good reasons especially with a looming global recession.

I’ve been studying the Early retirement Now Safe withdrawals rate posts series pretty carefully (https://earlyretirementnow.com/2016/12/07/the-ultimate-guide-to-safe-withdrawal-rates-part-1-intro/). I haven’t finished yet. My conclusion so far is that it should be 3.25% rule or even 3% rule to be on the safe side.

Close to 70% is this month. But the average is 40 something percent for 2019 so far. But, I anticipate more good months coming ahead. Let’s see 🙂

The sign of Bitcoin is BTC, ISO code is BTC.